Meanwhile, residents in the London borough of Wandsworth will be subject to just a 2% increase, while those in Rotherham will see council tax going up by 2.85%.

Councils are allowed to increase council tax by a maximum of 5% – with a referendum or exceptional circumstances to go beyond this. The government bills the average increase as the lowest in two years, down from 5.1% in 2023-24 and 2022-23.

There are steps you can take if you’re worried about being able to afford council tax. Many qualify for exemptions, while there are a huge range of grants available. More details of the support on offer can be found here.

Water bills

Water bills in England and Wales are set to go up by an average of £10 a month from April, after Water UK announced the changes in January. It means average bills will increase by £123 a year to £603 a year.

But not all areas are equal. Southern Water customers will see their bills increase by 47%. Thames Water customers face a 31% hike. South West Water, Hafren Dyfrdwy and Bournemouth Water bills will go up by 32%.

In Scotland, bills will increase by nearly 10%.

Advertising helps fund Big Issue’s mission to end poverty

Water companies say the increase is down to an increase in infrastructure spend, mandated by regulator Ofwat as part of a five-yearly review cycle. The regulator has approved £140bn of investment over the next five years, which it says will clean up rivers and seas and secure long-term drinking water supplies.

Energy bills

Ofgem’s price cap is going up on 1 April, with prices set until 30 June. The average gas and electricity bill will increase by 6%, adding £9.25 to an average household’s monthly bill.

Help is available for those who cannot afford energy bills. Many energy companies offer support funds and grants, and more information can be found here.

TV license

The cost of a TV licence will increase by £5, bringing the cost to £174.50. It is less than the £10.50 rise in 2024, and is calculated using an annual inflation rate. The change represents an increase of 2.9%.

Alongside the increase, the government says it is extending the “simple payment plan”, which helps households with financial difficulties pay for the license. Under this scheme, if a payment is missed it can be spread over the rest of the billing period rather than customers having to pay double the next month. However, those who miss three consecutive payments are removed from the plan.

Car tax

Electric, zero, or low emission vehicle owners will be required to pay vehicle tax from 1 April. They had previously been exempt. Owners of new vehicles – registered on or after 1 April – will pay £10 for the first year and £195 from the second year. Other rates depend on how long a vehicle has been registered.

Advertising helps fund Big Issue’s mission to end poverty

The most polluting – which include Aston Martin V8 Vantages, Lamborghini Huracans, five-litre V8 Ford Mustangs, and the 6.75-litre V12 Rolls-Royce Ghost – could see bills go up from £2,745 to £5,490. The changes are expected to raise £400m in a single year for the Treasury.

For most drivers, there will be a general increase of £5 a year to £195 a year. But increases for petrol, diesel, and hybrid vehicles will depend on how much a vehicle emits.

Mobile and broadband

Many phone and broadband companies hit loyal customers with a price increase every April, often based on the rate of inflation plus a certain amount.

For example, most EE customers who were with the company before 10 April 2024 will see their contract increase by 6.4%. Virgin Media customers who took out a broadband deal before 9 January will face an increase of 7.5%.

In July last year, Ofcom announced a ban on price increases measured by inflation. Instead, customers must be told upfront about increases in pounds and pence. The regulator found most broadband and mobile customers do not know what inflation rates such as CPI and RPI measure.

Maternity and paternity pay

Maternity and paternity pay, as well as adoption, shared parental, and parental bereavement pay will go up from £184.03 to £187.18 per week.

Advertising helps fund Big Issue’s mission to end poverty

What you receive depends on which is lower: 90% of your average weekly earnings, or the statutory amount, meaning you could receive less.

Statutory sick pay

Statutory sick pay will increase from £116.75 a week to £118.75 a week. But you must earn £125 per week to qualify.

National Living Wage

Workers aged 21 and over on the National Living Wage will see their pay rise by 6%. An hourly increase from £11.44 to £12.21 represents an annual pay rise of over £1,400 a year.

For those aged 18 to 20, the National Minimum Wage will increase by 16.3% to £10 an hour.

Stamp duty

If you’re buying a house and haven’t completed by 31 March, it’s likely it’ll get more expensive. The stamp duty threshold for first-time buyers will decrease from £450,000 to £300,000. For an average property, this will mean buying a first home becomes over £6,000 more expensive.

The threshold for everyone else will decrease from £250,000 to £125,000, meaning an additional £2,500 bill for anybody buying a property worth over £250,000.

Advertising helps fund Big Issue’s mission to end poverty

The change has been branded a “punishment for the young”, in contrast to Labour’s promises to make housing more affordable.

Social rents

Rents for those living in a socially rented home will increase in April by a maximum of 2.7%.

It means if you’re paying £1,000 a month, your rent will increase to £1,027 a month.

Increases on social rents are capped at CPI inflation rate in the previous autumn plus 1%, and so this year’s increase is based on an inflation rate of 1.7% in September 2024.

Last year’s increase was 7.7%.

State pension

From April 7, the state pension will increase by £473 a year thanks to the triple lock.

Advertising helps fund Big Issue’s mission to end poverty

This picks the highest out of wage growth, inflation, or 2.5%. This year, pensioners have wage growth to thank for an increase of 4.1%, bringing the full state pension to £11,973 a year.

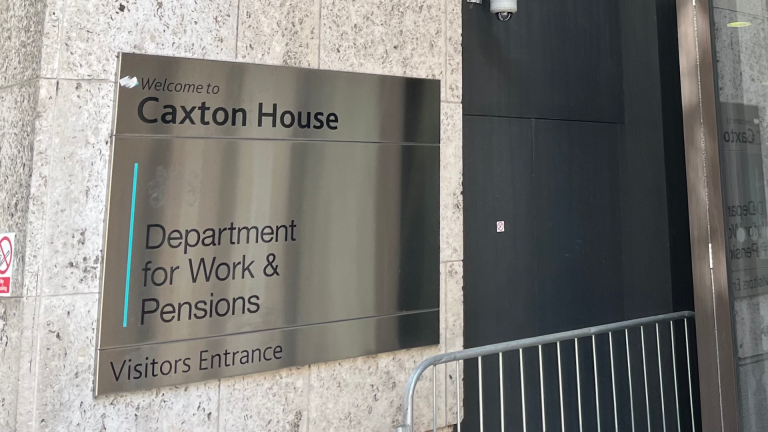

DWP benefits increases

Most benefits payments – including universal credit, PIP, and disability living allowance – will increase by 1.7%, in line with the CPI measure of inflation.

The benefits cuts announced by Liz Kendall and Rachel Reeves in recent weeks have not come into force yet. MPs will vote on the benefits changes, many of which are planned to come into effect in 2029.

Do you have a story to tell or opinions to share about this? Get in touch and tell us more. Big Issue exists to give homeless and marginalised people the opportunity to earn an income. To support our work buy a copy of the magazine or get the app from the App Store or Google Play.

Big Issue is demanding an end to extreme poverty. Will you ask your MP to join us?